-

Koehler Invest GmbH and venture capital firm b-to-v join as new investors

-

BigRep is one of Germany’s fastest growing hardware startups

-

BigRep is investing new capital in research and development, expanding its global market leadership, internationalizing and strengthening distribution

Berlin, November 11, 2015. BigRep, developer and manufacturer of the world’s largest serially produced 3D printer, has successfully closed a Series A financing round. The family-run Koehler Paper Group and venture capital firm b-to-v will join existing shareholders such as KFW-Bankengruppe and its ERP-Startfonds, to invest over €7 Million in BigRep GmbH. “We are thrilled to have found further investors with Koehler and b-to-v who appreciate the capacities of our large-scale serial 3D printing solutions and share our vision: as the 21st century’s key industry, 3D printing will substantially change global supply chains and production processes. We will use this fresh capital to further our product development, expand our global market presence, and to internationalize and strengthen our distribution,“ says BigRep CEO René Gurka.

The Koehler Paper Group has been investing in new technologies increasingly via financial involvement with startups in recent years. The industrial enterprise, family-run for eight generations, also plans to participate in the growing market for 3D printing. “We have thoroughly studied the market for 3D printing and are positive that BigRep is one of the best positioned providers in the rapidly growing segment for industrial clients,” Koehler Paper Group CEO Kai Furler states.

With offices in St. Gallen and Berlin, venture capital firm b-to-v is one of the leading networks for entrepreneurial private investors in Europe. Dr. Christian Reitberger, Lead Investor at b-to-v, was previously involved in BigRep’s seed funding as a Business Angel: “BigRep’s aim is to reduce the entry barriers for industrial 3D printing through lower operating costs, establishing a coherent software environment, and smart filament material innovations. BigRep will access new customer groups for additive manufacturing and provide industry insiders with a wider applicability in everyday use, too“.

A Rapidly Growing Market

The market for professional 3D printing has been growing rapidly: the annual growth rate is expected to increase by approx. 20 percent by 2020. Wohlers Report, the industry’s preeminent source, estimated the worldwide market for 3D

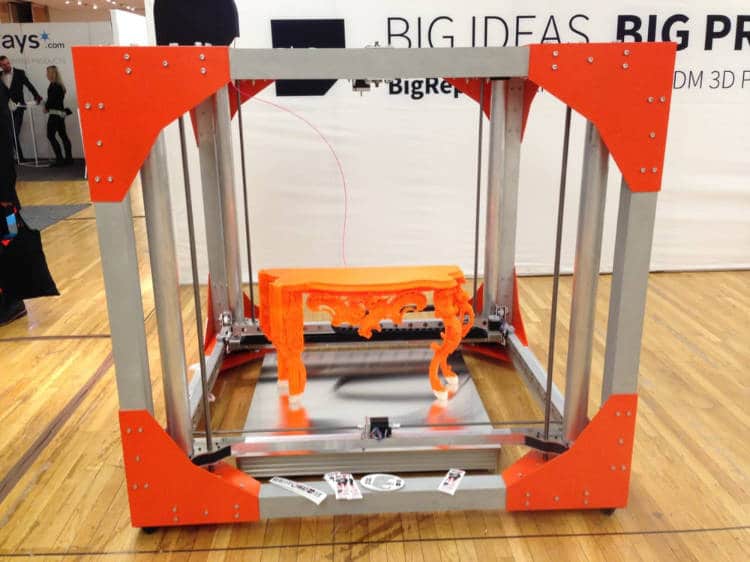

printing was worth over US$5 billion in 2015. The competition is relatively small in the segment for large-scale serial 3D printing, particularly cost-efficient 3D printing solutions. This is not the only field where BigRep has succeeded in establishing global market leadership in just 18 months. Thanks to its unique printing volume of over 1m3, which allows for prints 27 times the size provided by customary appliances, as well as its integrated software solutions, the BigRep ONE, which is available already in its third generation, also sets the industry’s technological standard.

About b-to-v:

b-to-v Partners AG is a venture capital company with offices in St. Gallen and Berlin. With around 200 members, it is also one of Europe’s leading networks of private entrepreneurial investors. b-to-v combines the industry expertise and experience of its entrepreneurs with the longstanding venture capital expertise of its in-house team. With this investment approach, b-to-v has set itself the goal of generating sustainable added value for its portfolio companies and investing entrepreneurs. At core, the b-to-v philosophy is all about investing together and a desire to mutually benefit from the financial, content-based and personal support provided from entrepreneur to entrepreneur. So far, b-to-v has invested in Facebook, Xing, Linguee, Qype, and Finanzchec, among others.

About KfW Bankengruppe:

The KfW Group finances and supports, among other things, business startups, small and medium-sized enterprises (SME) as well as investments in economic growth and employment projects in Germany. The ERP Start-up-Fund, administered and co-financed by KfW, offers equity financing for innovative, technology-based enterprises with excellent growth prospects. The fund finances research and product development as well as the launching of new products, procedures and services. KfW always cooperates with a lead investor and exclusively adopts market conditions. Since 2004, the ERP Start-up-Fund has had €720 Mio. at its disposal to support emerging technology-based companies.